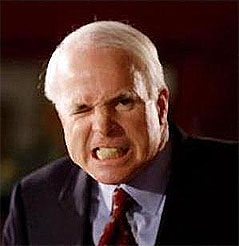

Yes, it seems as though the best chance Senator John McCain thinks he has is to throw mud, and he has begun the slinging by continuing the nonsensical charges about an association with someone who was a sixties radical that has been debunked in the major press outlets. Meanwhile, those same outlets (Reuters, CNN, New York Times) are reporting a gross abuse of power by McCain’s running mate, Governor Sarah Palin. What’s the chance that he has actually associated with Mrs. Palin? And this is the thing that scares me the most about this Republican ticket. Normally, I could care less about the VP pick. However, as the current VP has demonstrated an unhealthy predilection to abuse his power, I would like to see the practice stop. Worse, McCain is no spring chick. He could actually die in office, and this woman would then be able to continue her perssonal crusades, not from the Governor’s office, but from the Whitehouse.

In the meantime, President Bush is nowhere to be found, except in a sketchy piece in today’s New York Times, in which he told people that it’s a good thing he’s still president and that he wouldn’t have wanted to deal with the economic mess his own deregulation helped create day one in office. The problem with this statement is that he has spoiled nearly everything he has touched: our budget, education, foreign policy, our Constitution & Bill Of Rights, our standing in the world, and many other things. Please let’s hope the damage can be contained by a prompt change of power.

I am sure I’m not that different from many others when I ask the simple question, what happened? How did the banks get into such a mess? What didn’t they see, and what regulation failed? Was the reserve ratio that the federal reserve demands too low? Did debt move from regulated to unregulated, and if so, why would that have caused a failure of regulated banks? How is it that the vast amount of debt went unrecorded until recently? And what are we doing wrong now?

I am sure I’m not that different from many others when I ask the simple question, what happened? How did the banks get into such a mess? What didn’t they see, and what regulation failed? Was the reserve ratio that the federal reserve demands too low? Did debt move from regulated to unregulated, and if so, why would that have caused a failure of regulated banks? How is it that the vast amount of debt went unrecorded until recently? And what are we doing wrong now? NPR’s Morning Edition today had a report on Governor Sarah Palin. Apparently she is taking a page from President Bush and carefully controlling media access. In other words: limited interviews, and no press access. What little press she has had has been bad. Between the ongoing investigation and her refusal to release her income tax records, one has to wonder if she really is ready for her current position of governor, much less that of vice president. One also has to wonder why the people of Alaska put up with this sort of behavior.

NPR’s Morning Edition today had a report on Governor Sarah Palin. Apparently she is taking a page from President Bush and carefully controlling media access. In other words: limited interviews, and no press access. What little press she has had has been bad. Between the ongoing investigation and her refusal to release her income tax records, one has to wonder if she really is ready for her current position of governor, much less that of vice president. One also has to wonder why the people of Alaska put up with this sort of behavior.