Here are three simple tests to determine whether a site is a trustworthy news outlet. Are there multiple sections? Does it have multiple news bureaus? Does the site post corrections?

The great New York Senator Daniel Patrick Moynihan famously said that everyone is entitled to his own opinion, but not his own facts. Unfortunately, our democracy is being undermined by a combination of an epidemic of fake news and people being willing to believe the drivel.

What, then, are trustworthy news outlets? To start with, they have to have paid reporters. Determining the truth requires investigation with feet on the ground. It requires document searches, interviews, and research. That costs money.

Still, a well funded propaganda outfit could pay (or claim to pay) for “reporters”. How to tell the difference? Be suspicious of any site is primarily focused on national politics or any single issue.

Here are a three tests to guide someone as to whether a news outlet is likely legitimate for daily consumption. The tests themselves aren’t perfect, but they’re pretty good.

1. Does the outlet have many news bureaus?

A real newspaper will have at least one regional bureau for the region they are covering, and will often have an additional bureau for a state capital or for Washington. Fake news sources may not have any bureaus. A simple test is to type the name of the site and then “news bureaus” into a search engine and examine the results. Note that a regional paper will tend to have only a few bureaus outside their region. That’s okay, so long as they stick to news where they have those bureaus and more importantly reporters.

2. Does the outlet have multiple unrelated sections?

Real news sources will have sections such as weather, sports, obituaries, arts, finance, and region, as opposed to just politics. They may not have all of these sections: for instance, the Wall Street Journal doesn’t have a weather section, but their finance section is unparalleled.

3. Does the outlet ever publish corrections?

Even if the answer to the first two questions is “yes”, no one is perfect. But a good news outlet will recognize their imperfections and always seek to report the truth, no matter how embarrassing it may be. A good measure of an outlet’s trustworthiness is how regularly they correct themselves.

Let’s Test

Given these parameters let’s see whether a web site is a good source for news.

| Source |

Multiple Bureaus? |

Unrelated Sections? |

Corrections? |

| The New York Times |

Multiple, throughout New York, US, and the world |

NY region, sports, weather, obits, arts |

Regularly at the bottom of an article online, or in a section in paper. |

| Fox News |

Multiple affiliates |

Sports, weather, numerous regions |

Not too often. |

| Breitbart |

Four bureaus |

no |

Very rarely |

| Wikipedia |

No |

Yes (vast) |

Entries are continually edited |

| The Daily Caller |

No |

No |

Never |

| NPR |

Many regional affiliates along with international bureaus |

Numerous |

Regularly online and on radio |

| The Wall Street Journal |

Strong presence in financial capitals |

Finance, Travel, even some Sport |

Regularly at the bottom of articles |

| Politico |

Primarily national, with a few state and international bureaus |

No |

Very Rarely |

Trust, of course, is not a binary. That’s why it’s important to get information from multiple sources, maybe not every day, but regularly. Also, just because something is not marked as a trustworthy news outlet doesn’t mean their lying. It does however, mean, that they’re something other than a trustworthy news outlet. A blog, perhaps, or an analysis site. Wikipedia is an interesting case because nobody gets paid, but the information tends to be reasonably trustworthy (or at least transparent).

All of this doesn’t get people off the hook from using their common sense. RT would easily pass the above tests, and yet they are a well known and well funded propaganda arm of Vladimir Putin. Probably not a good news source. Most blogs aren’t so well funded.

When we talk about secure platforms, there is one name that has always risen to the top:

When we talk about secure platforms, there is one name that has always risen to the top:

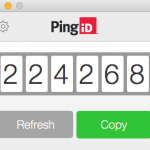

If the best and the brightest of the industry can occasionally have a flub like this, what about the rest of us? I recently installed a single sign-on package from

If the best and the brightest of the industry can occasionally have a flub like this, what about the rest of us? I recently installed a single sign-on package from  The Wall Street Journal is reporting

The Wall Street Journal is reporting