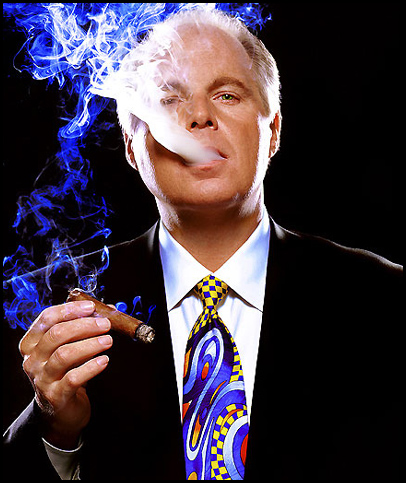

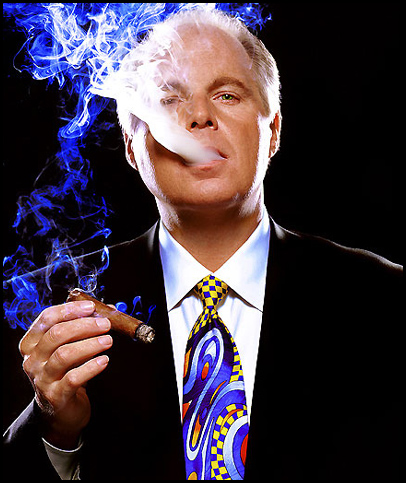

Of course we’re talking about Rush Limbaugh. In an Op-Ed piece in the Wall Street Journal he argues that a stimulus package should satisfy both “supply-siders” and “Keynesians”. He also makes the argument that Obama didn’t win the election by that much.

Of course we’re talking about Rush Limbaugh. In an Op-Ed piece in the Wall Street Journal he argues that a stimulus package should satisfy both “supply-siders” and “Keynesians”. He also makes the argument that Obama didn’t win the election by that much.

I find both arguments unpersuasive. Let’s start with the last one first. No matter how you break down the percentages of the presidential election, Obama won. I don’t recall Mr. Limbaugh making an argument that President Bush should reach out to the Democrats when Al Gore won the election in 2000. In addition, Republicans had their clocks cleaned in both the House and the Senate. A sufficient mandate exists that the Republicans will not stop President Obama. As I’ve previously written, congressional Democrats will be opposition enough. Limbaugh knows this, which is why he then tries to base his argument on a poll, which says that 59% of Americans think Congress and the president will spend too much. Whatever. Nobody ever got thrown out of office for growing the deficit.

But is Mr. Limbaugh correct when he suggests that both supply side and direct government investment in various efforts is the right way to go forward? Normally, I would view taking both roads as failing the Yogi Berra test: when you come to a fork in a road, take it. And yet this is often something that politicians can’t do. They often can’t make a stand. This is, for instance, why no declaration of war has been made by the Congress since World War II.

The theory behind supply-side economics is that when businesses have lower costs (say through lower taxes), either they will receive more revenue, in which case they will invest it and end up hiring more people, and thus help GDP and jobs, or they will cut their prices, in which case the consumer will spend the money somewhere else and also increase GDP and drive businesses to create more jobs. This assumes that the obstruction to investment today is somehow related to a lack of cash. This is not the case, today.

Many companies are sitting on fortunes that they are not spending, and those that would like to spend – generally start-ups, are unable to get credit from banks. No amount of tax cuts will help a start-up right now. No amount of tax cuts will cause companies to expand in the current environment. Everyone is scared that the consumer lacks cash.

And so while under some circumstances it might make sense to play the supply-side game, the more direct approach is to address consumer confidence by seeing that they have have jobs. The problem with government spending models is that they tend to produce jobs that we as Americans don’t think much of. When was the last time you worked on a crew that built a road, for instance?

Some of the president’s initiatives go into health care and education. It is a sure bet that such money will find its way back into the economy. In fact, nearly all of the programs will bring money to the economy. But a restructuring seems inevitable.

Sadly Mr. Limbaugh couldn’t get past his own partisan blinders to offer a candidate assessment of the situation.

Today the Voice of America

Today the Voice of America  Of course we’re talking about Rush Limbaugh. In an

Of course we’re talking about Rush Limbaugh. In an  Today’s CNN

Today’s CNN  A lawsuit? That is what some shareholders are rumoured to be considering, because they feel as though they were kept in the dark about the struggling CEO’s health. While Jobs is known to be an aggressive man in many respects, his health is something he may have very little control over, as we probably know lots less than we don’t about the human body.

A lawsuit? That is what some shareholders are rumoured to be considering, because they feel as though they were kept in the dark about the struggling CEO’s health. While Jobs is known to be an aggressive man in many respects, his health is something he may have very little control over, as we probably know lots less than we don’t about the human body.